Behind the Libor Scandal

SEE LINKS AT THE END

The recent settlement with Barclays Bank over its LIBOR(1) fixing fraud has gotten.... some.... attention. Not a lot of attention, though. Why is that, given that this fraud potentially affected trillions of dollars in assets?

I think the obvious answer is that (a) it's really complicated and (b) everyone's a little vague about just who got ripped off here. On a list service I subscribe to, a seemingly knowledgeable participant (2) said the victims of the scam include investors who owned floating rate notes, LIBOR-linked CDs, or pay-fixed-receive-floating interest rate swaps; or anyone who traded LIBOR contracts on a U.S. futures exchange and lost money. And let's face it: that doesn't sound much like widows and pensioners, does it?

What's more, the LIBOR scam wasn't about pushing LIBOR systematically up or down. Sometimes it was pushed up, sometimes it was pushed down, depending on whatever happened to be good for the Barclays trading desk on any given day.

The attempts to rig LIBOR [...] not only betray a culture of casual dishonesty; they set the stage for lawsuits and more regulation right the way round the globe. This could well be global finance’s “tobacco moment”....Despite the risks of banker-bashing, a clean-up is in order, for the banking industry’s credibility is shot, and without trust neither the business nor the clients it serves can prosper.

Right now the scandal is not limited to Barclays, UBS is said to be next in line, and other banks that haven't cooperated as willingly will take longer to prosecute. In theory, though, the news is likely to be even worse once those cases finish up.

Roughly speaking, the view from inside Barclays is that they're being treated unfairly. They cooperated, after all, and they say that other banks were way more involved in the LIBOR-fixing scam than they were. If that's true, one of two things will happen.

Either this scandal will explode way beyond the financial press, where it's mostly played out so far. Or it will turn out that declining to cooperate makes it really hard to prosecute the other banks and Barclays will look like idiots for doing so. I'm not sure which to put my money on.

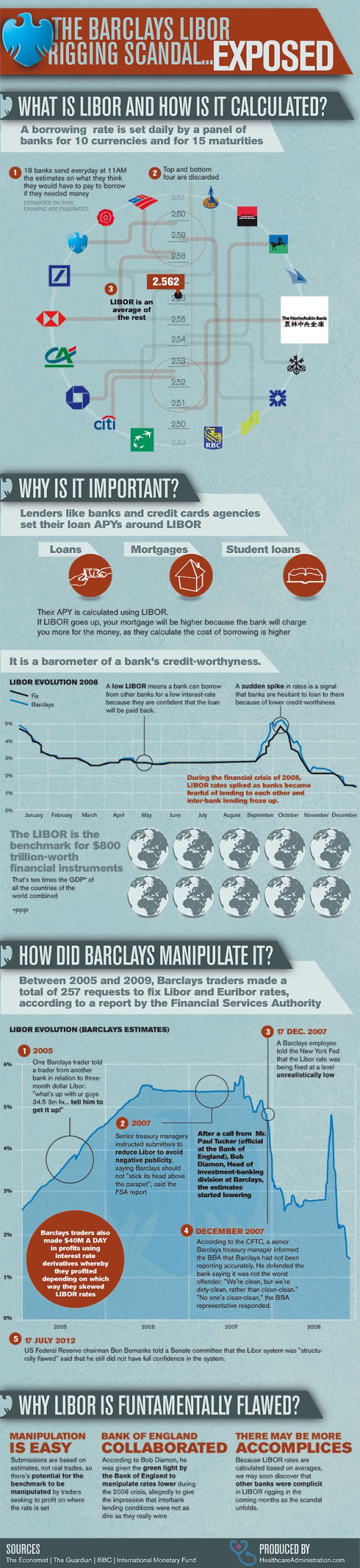

1LIBOR is the London Interbank Offered Rate. It's basically the current interest rate banks charge each other to borrow money, and it changes on a daily basis. So if you have an adjustable rate mortgage, for example, your interest rate might be LIBOR + 3, or something like that.

2How's that for a reliable source?

Culture of Casual Dishonesty

As I spend most of days trying to recover from Traumatic Brain Injury - does one actually "recover" from such? I have been reading Economic materials to stimulate my cognitive processing. And I am beginning to wonder if Bankers have Traumatic Brain Injury they seem to exhibit much of the same traits and behaviors.

Typical behavioral problems experienced by traumatic brain injury survivors include:

Self-centeredness

Aggression

Inappropriate sexual behavior

Extreme temper

Cursing

Manipulative behavior

If that doesn't describe a banker what does? Shoot I may have a new career as at least mine is official.

To many the LIBOR scandal is not even on the radar or its thought of as some scandal in England. Well in this case you are half right. But its actually also being handled in England appropriately. And like the Murdoch scandal it is not being ignored. If anyone thinks that the Murdoch's kept their illegality and impropriety in Journalism confined to across the pond I have a bridge to sell you and JP Morgan Chase can finance it for you.

I think Matt Taibbi from Rolling Stone, a writer whose ire I admire, does an excellent job covering technical economic issues I think with plain speaking and the rough edges I admire. Here is the link to his blog articles on the subject:

See the BOE note in the article

US Treasury Secretary Timothy Geithner is also expected to appear before the Senate Banking Committee in the coming weeks to face similar questions.

Last Friday the New York Federal Reserve, which Mr Geithner was in charge of at the time, released a trove of documents showing that Barclays informed the regulator about its concerns over Libor manipulation as far back as August 2007.

The documents also showed that by June 2008 Mr Geithner was concerned enough to formally contact Bank of England Governor Mervyn King to report the problems relating to Barclays and other banks, and made recommendations to shore up the Libor setting process.

The Bank passed the email on to the British Bankers Association (BBA), which, according to Mr King, assured both the Bank and the NY Fed that it would take on board the recommendations.

The BBA has responsibility for overseeing Libor. It is not yet clear how it dealt with the information from the Fed.

And I have reprinted the article below from today's New York Times and it does a great and simplistic way of explaining why LIBOR matters.

The British, at Least, Are Getting Tough

The unfolding story of how Barclays — and, in all likelihood, other big banks — rigged interest rates is full of telling tidbits about the way Wall Street works. It also represents yet another teachable moment.

By now the world knows that Barclays manipulated the most widely used benchmark rate, the London interbank offered rate. But Barclays is just one member of the cozy club that sets the Libor, which is supposed to be based on the average rate at which large banks can borrow money overnight. It’s not based on actual transactions, however — and that leaves room for mischief.

And mischief there was, according to e-mails and other documents that Barclays has turned over to regulators in the United States and Britain. The upshot: traders colluded by posting rates that either helped their bets in the markets or their bank’s perceived financial strength during the harrowing days of 2008.

In October 2008, a Bank of England official questioned why Barclays’ submissions were high compared with other banks. After this, the Barclays rates fell closer to those of other banks. Barclays has released documents saying that some bank executives believed the official had instructed them to lower its rates, but the official has denied any improper actions.

Manipulating the Libor is a big deal because it affects the cost of money for almost everyone. The Libor is used to set rates on mortgages, credit cards and all manner of loans, personal and commercial. The amount of money affected by the phony rates is at least $500 trillion, British regulators have estimated.

Barclays is not the only bank under investigation for rigging the Libor. It was simply the first to own up to the behavior and settle with regulators, paying $450 million. Other banks will almost certainly follow, and the documents bound to bubble up in those cases will surely prove fascinating.

One of the most revealing exchanges in the Barclays documents came when a bank official tried to describe why Barclays’s improper postings were not as problematic as those of other banks. “We’re clean but we’re dirty-clean, rather than clean-clean,” an executive said in a phone conversation. Talk about defining deviancy down.

“Dirty clean” versus “clean clean” pretty much sums up Wall Street’s view of cheating. If everybody does it, nobody should be held accountable if caught. Alas, many United States regulators and prosecutors seem to have bought into this argument.

British authorities have not. Last week’s defenestrations of Marcus Agius, the Barclays chairman; Robert E. Diamond Jr., its hard-charging chief executive; and Jerry del Missier, its chief operating officer, apparently occurred at the behest of the Bank of England and the Financial Services Authority, the nation’s top securities regulator. (Mr. del Missier also seems to have lost his post as chairman of the Securities Industry and Financial Markets Association, the big Wall Street lobbying group. His name vanished last week from the list of board members on the group’s Web site.)

MR. DIAMOND seemed shocked to be pushed out. An American by birth, he probably thought he’d be subject to American rules of engagement when confronted with evidence of wrongdoing at his bank. You know how it works on this side of the Atlantic: faced with a scandal, most chief executives jettison low-level employees, maybe give up a bonus or two — and then ride out the storm. Regulators, if they act, just extract fines from the shareholders.

British officials are taking a different approach with this scandal. George Osborne, the chancellor of the Exchequer, was direct in his assessment of Barclays’s activities. “It is clear that what happened in Barclays and potentially other banks was completely unacceptable, was symptomatic of a financial system that elevated greed above all other concerns and brought our economy to its knees,” he said in a statement on June 28. “Punish wrongdoing. Right the wrong of the age of irresponsibility.”

Later, in a speech to Parliament, Mr. Osborne voiced the question that so many have asked recently in the United States. “Fraud is a crime in ordinary business — why shouldn’t it be so in banking?” he asked.

Perhaps the biggest lesson from the Libor scandal is how dangerous it is to rely on interested parties to set interest rates or prices of financial instruments, rather than on actual transactions conducted by investors. The Libor has been set in the current and vulnerable manner since the late 1960s. Maybe it has never been rigged before, but who knows?

It is far better to have the transparent and verifiable record of prices created by a tape of electronic trading. Such records are standard pricing mechanisms for many securities. But not all.

Prices of derivatives, especially credit default swaps that trade one-to-one, can still be based on one dealer’s say-so. That’s why a rule proposed by the Commodity Futures Trading Commission that would require pretrade price transparency in the swaps market is so important.

But it is also why Wall Street is pushing back, especially on the commission’s proposal that swap execution facilities provide market participants, before they buy or sell, with easily accessible prices on “a centralized electronic screen.” The commission’s rule would eliminate the one-to-one dealings by telephone that are so lucrative to traders and so expensive to investors.

A bill intended to gut the commission’s proposed rule and to maintain dealers’ profits in derivatives failed to go anywhere after being passed last year by two committees in the House of Representatives — Financial Services and Agriculture. That was a good thing.

But there are rumblings in Washington that this bill has resurfaced and that it may be quietly attached to a House Agriculture Committee appropriations bill scheduled for a vote this month. The bill, if passed, would bar the requirement for a centralized pricing platform to shed light on the enormous swaps market. It would also prevent regulators from requiring that a number of participants provide price quotations to customers, a way to ensure fairness.

It’s hard to believe, in the wake of the Libor mess, that Wall Street and its supporters in Congress would continue to battle against price transparency in any market. Then again, that’s precisely what they did after the credit crisis.

With each new financial imbroglio, the gulf widens between Main Street’s opinion of Wall Street and the industry’s view of itself. When Mr. del Missier, the former Barclays chief operating officer, took over as chairman of the Securities Industry and Financial Markets Association last November, he said: “We will continue to work on maintaining and burnishing the level of confidence investors have in our markets, in our own financial institutions, and in the general economic outlook for the future.”

Given the Libor scandal, let’s just say good luck with that.

SOME COMPLEMENTS SEE :

Le Temps LA CHRONIQUE DE JEAN-PIERRE BÉGUELIN Samedi14 juillet 2012

How it works and how it affects everybody